is colorado a non community property state

The withholding tax when imposed is the lesser of two percent of the sales price rounded to the nearest dollar or the net proceeds from the sale. Colorado is NOT a community property state which means that marital property is not automatically divided 5050 between the spouses in a.

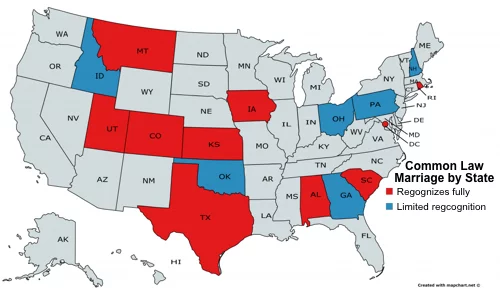

Community Property States List Vs Common Law Taxes Definition

Colorado is an equitable distribution or common law state rather than a community property state.

. Colorado is an equitable distribution divorce state. To create a co-ownership in joint tenancy the instrument conveying the property must state that the property is conveyed to the grantees in joint tenancy or as joint tenants. If you are considering a divorce and have questions regarding how your property will be divided between.

It uses a common law doctrine rather than one based on the laws of community property. Colorado is an equitable distribution state. Its considered a separate property or equitable distribution state.

Community property law is a form of property ownership which dates back to the year 693 in Visigothic Spain. The short answer is no Colorado is not a community property state. The Court will consider a variety of factors when determining a fair division.

Is Colorado is a community property state. That means marital property isnt automatically assumed to be owned by both parties and therefore should be divided equally upon divorce. The division of property is one of the main issues during a divorce case in Colorado.

Yes- Both husband and wife must execute deed of trust which is to encumber property of the community. However non-owner spouse should execute a disclaimer of interest in the property Quitclaim Deed Interspousal. Instead when a couple divorces in Colorado the marital property is divided in an equitable manner.

The general rule is that community property is divided 5050. The Colorado Common Interest Ownership Act CCIOA is a set of laws that govern the formation management powers and operation of common interest communities HOAs in Colorado. Colorado is not a community property state but it does have a category called marital property In Colorado most assets acquired during a marriage are considered marital property which is subject to division by the courts in a divorce.

Instead Colorado courts divide the property of divorcing couples using a method called equitable distribution But what does that mean. Colorado is not a community property state as courts do not assume that the property obtained during the course of a marriage is all marital property. Colorado is an equitable distribution or common law state rather than a community property state.

Colorado is an equitable distribution state which means property will be divided by the court in a manner that. Colorado is a marital property state meaning the marital estate will be divided equitably vs. Below is a List of Spousal States and Community Property States.

Colorado imposes a withholding requirement on corporations that do not maintain a permanent place of business in Colorado and non-resident individuals estates and trusts on the sale of real estate in excess of 100000. In our Summit County real estate market where many of our buyers and sellers are not residents of the state of Colorado this comes up quite a lot. The nine states that DO have a community.

Joint tenancy can only be created if expressly stated in the deed. Courts have much more leeway to determine how property is divided in equitable distribution states The majority of community property states wont deviate from the 5050 division regardless of the circumstances. Is Colorado A Non Community Property State - Colorado is not a community property state but it does have a category called marital property in colorado most assets acquired during a marriage are considered marital property which is subject to division by the courts in a divorce.

Unlike in community property states anything deemed to be marital property in Colorado is not assumed to be owned equally by both spouses and does not have to be divided equally in a divorce. But there may be certain exceptions to this rule. Instead of dividing property 5050 in a divorce case the Colorado courts will divide marital property assets and debts in a way that is.

Currently nine other states are also community property states. However its important to be aware of how the community property rules could affect your estate plan in the case youre relocating into or out of a. Colorado is not a community property state as courts do not assume that the property obtained during the course of a marriage is all marital property.

While most of the important provisions in CCIOA apply to all common interest communities regardless of when those communities were created some provisions apply only to communities created. Is Colorado a community property state. This can be done using the phrase as joint tenants with right of survivorship or in joint.

That means marital property isnt automatically assumed to be owned by both parties and therefore should be divided equally upon divorce. Community property designates that all of the assets and debts gained during the marriage belong equally to both people and must be distributed equally in the case of divorce. Arizona california idaho louisiana nevada new mexico texas washington.

Is Colorado A Non Community Property State. Colorado is an equitable distribution or common law state rather than a community property state. People often ask.

As a result assets within a marriage will be divided equitably among the spouses under Colorado law. Colorado is a marital property state not community property. If record title to real property is held as a spouses sole and separate property signature of non-owner spouse is not required.

Colorado 2 Withholding on Real Estate transactions. As many of our readers know Colorado is not a community property state when it comes to divorce. If you are a non-Colorado resident and you sell your Colorado property the title company may be required to withhold a portion of your proceeds for state income tax.

Does it mean equally 5050. It uses a common law doctrine rather than one. In non-community property states on the other hand the assets of the debtor spouse are separate from the other spouse unless both spouses are indebted to the same creditor.

Colorado is fair circulation or acommon lawa state as opposed to community property state.

Community Property States List Vs Common Law Taxes Definition

Community Property States List Vs Common Law Taxes Definition

Community Property States List Vs Common Law Taxes Definition

Which States Are Community Property States In Divorce

![]()

Divorce In No Fault States South Denver Law

Is Colorado A Community Property State Cordell Cordell

Who Gets The House In A California Divorce Divorcenet

How Are Divorce Settlements Calculated Findlaw

Marital Property States Legalmatch

Which States Are Community Property States In Divorce

Georgia Marital Property Laws The Definitive Guide Lawrina

Division Of The Marital Estate Colorado Family Law Guide

Community Property States List Vs Common Law Taxes Definition

Community Property States List Vs Common Law Taxes Definition

Which States Are Community Property States In Divorce

Which States Are Community Property States In Divorce

Community Property States List Vs Common Law Taxes Definition

Divorce And Dissipation Hidden Assets And Spending Griffiths Law